prince william county real estate tax records

You can pay a bill without logging in using this screen. Enter street name without street direction NSEW or suffix StDrAvetc.

Enter the house or property number.

. Request a Filing Extension. Your subscription will start on the day entered into the computer. The property tax calculation in Prince William County is generally based on market value.

You may view the 2022 assessments via the online Real Estate Property Assessment System. The Prince William County assessors office can help you with many of your property tax related issues including. If you are searching by sale date please enter it in the following format.

Than 6 characters add leading zeros to it before searching. 180 Horse Landing Road King William VA 23086. NETR Online Prince William Prince William Public Records Search Prince William Records Prince William Property Tax Virginia Property Search Virginia Assessor From the Marvel Universe to DC Multiverse and Beyond we cover the greatest heroes in Print TV and Film.

Please have the Virginia Code section that would apply. Information on your propertys tax assessment. Submit Consumption Tax Return.

Click here to register for an account or here to login if you already have an account. Their phone number is 703 792-6035. 300000 100 x 12075 362250.

Checking the Prince William County. Submit Consumer Utility Return. Market value is the probable amount that the property would sell for if exposed to the market for a reasonable period with informed buyers and sellers acting without undue pressure.

Prince William County - Log in. Account numbersRPCs must have 6 characters. Submit Business Tangible Property Return.

The real estate tax is paid in two annual installments as shown on the tax calendar. Prince William County Real Estate Assessor. 4379 Ridgewood Center Drive Suite 203 Prince William VA 22192.

Due to the high volume of emails we are receiving please note that response times are longer than normal. You can contact the Prince William County Assessor for. 3 rows Prince William County Property Tax Collections Total Prince William County.

Copies of subdivision plats are available for purchase at the Clerk of Circuit Court Land Records located at 9311 Lee Avenue 3rd Floor Manassas VA 20110. King William VA 23086. All real property in Prince William County except public service properties operating railroads interstate pipelines and public utilities is assessed annually by the Real Estate Assessments Office.

The tax rate is expressed in dollars per one hundred dollars of assessed value. Prince William County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Prince William County Virginia. Name A - Z Sponsored.

The Prince William County Assessor is responsible for appraising real estate and assessing a property tax on properties located in Prince William County Virginia. King William VA 23086. Report a Vehicle SoldMovedDisposed.

The Assessments Office mailed the 2022 assessment notices beginning March 14 2022. Appealing your property tax appraisal. For example if the total tax rate were 12075 per 100 of assessed value then a property with an assessed value of 300000 dollars is calculated as.

These records can include Prince William County property tax assessments and assessment challenges appraisals and income taxes. Mmddyyyy mmdd. Search Prince William County property tax and assessment records including sales search and parcel history by owner name or address.

Neither the Prince William County offices nor the Courthouse keep copies of individual house location surveysplats. Please note we are no longer pro-rating days. The Prince William County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Prince William County and may establish the amount of tax due on that property based on the fair market value appraisal.

Reporting upgrades or improvements. Your patience is appreciated. The cost is 240 per person.

If your account numberRPC has less. See reviews photos directions phone numbers and more for Prince William County Personal Property Tax Office locations in Fredericksburg VA. Submit Daily Rental Return.

Submit Business License Return. By creating an account you will have access to balance and account information notifications etc. Use both House Number and House Number High fields when searching for range of house numbers.

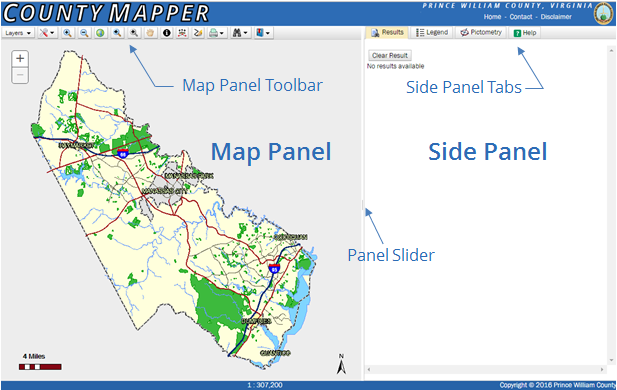

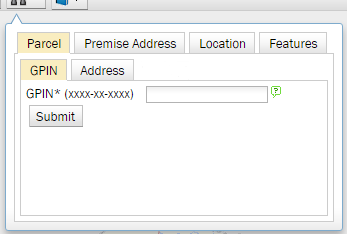

Sales Search If you have questions about this site please email the Real Estate Assessments Office. Submit Transient Occupancy Return. If you are searching by gpin please enter it in the following format.

Please contact Taxpayer Services at 703-792-6710 M-F 8AM 5PM. Report High Mileage for a Vehicle.

With Waterfront Homes For Sale In Prince William Va Realtor Com

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Wtop News

Prince William Co Residents Decry Proposed Hike In Tax Bills Wtop News

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Wtop News

Data Center Opportunity Zone Overlay District Comprehensive Review

Where Residents Pay More In Taxes In Northern Va Wtop News

Pin On Northern Virginia Trips And Tips

Prince William Prosecutors Seek More County Funding Headlines Insidenova Com

Prince William Supervisors Set To Approve Tax Hikes For Residents Restaurant Customers Tuesday

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements