closed end fund liquidity risk

All three fund types are pooled. Of closed-end fund shares is inelastic.

What Is The Difference Between Closed And Open Ended Funds Quora

Open-end mutual funds price their shares only once a day at the.

. Manzler 2004 shows that the discounts on closed-end funds are driven by. Ad This guide may help you avoid regret from making certain financial decisions. A closed end fund is a type of investment company whose shares are traded on the open market.

Additionally while a money market fund is an open-end management investment company money market funds are not subject to the rules and amendments we are adopting except. This is a significant risk for closed end bond funds as a default by one or more of the CEFs underlying bond holdings can have a significant impact on the CEFs NAV market price and. The use of leverage by a closed-end fund.

Questions may be directed to the. Their yields range from 632 on average for bond CEFs to 722 for the average stock CEF. CEFs are sometimes described as ancestors to exchange-traded funds but CEFs have a fixed number of shares while ETFs can raise or lower the figure as demand changes.

If you have a 500000 portfolio get this must-read guide by Fisher Investments. Learn how the more complex structure of closed-end funds can provide access to potentially higher-yielding segments of the market than more conventional open-end funds. The MLPs held by closed-end funds are often companies involved in energy storage or transportation including pipelines.

Closed-end funds are investment vehicles that bear a passing resemblance to mutual funds and exchange-traded funds ETFs. When investing in closed-end funds financial professionals and their investors should first consider the individuals. On a percentage basis the fund sells at a discount.

Lets assume that the market price is 18 per share and that NAV is 20. The SECs Division of Investment Management is happy to assist small entities with questions regarding the liquidity risk management rules. The SEC has concerns about allowing bitcoin ETFs.

Additionally we find that the higher the liquidity risk of a closed-end fund relative to its underlying portfolio the larger the closed-end fund discount market price of the closed end fund is. Mutual funds are open-end funds. They are retired when an investor sells them back.

A number of funds have earned 4- and 5-star ratings. The diagram below outlines the process relating to a closed-end mutual fund. Unlisted closed-end funds also provide limited liquidity.

Liquidity risk management program rule1 demand for asset classes that are not suitable for. A closed-end fund lists on a stock exchange where the shares trade just like stocks throughout the trading day. In this case the closed-end fund sells at a discount of 2 per share.

Thus the price is a function of the supply and demand for the shares trading on the market and has only an indirect link with the value of the assets. Ad Explore funds and choose those that align with your clients goals. Any day when theres a 1 move in a CEF can be thought of as a day when there is a supply and demand imbalance outside of ex-dividend days and large moves in interest.

Closed-end funds can offer advisers opportunities to introduce clients to successful portfolio managers and strategies at a discount when prices fall. A closed-end fund legally known as a closed-end investment company is one of three basic types of investment companies The two other types of investment companies are open-end funds. Our funds have star power.

Fortunately closed-end funds especially interval funds offer a better solution for retail investors wanting digital asset. A closed-end mutual fund as the name implies does not issue additional shares or buy back shares. Payouts can be substantial including tax-deferred return of.

Learn about closed end funds and how they can impact your personal investing strategy. The use of leverage allows a closed-end fund to raise additional capital which it can use to purchase more assets for its portfolio. New shares are created whenever an investor buys them.

The SEC adopted Rule 22e-4 the Liquidity Rule requiring each registered open-end fund including open-end ETFs but not money market funds to establish a liquidity risk. Closed-end funds CEFs can be one solution with yields averaging 673.

Difference Between Open Ended And Closed Ended Mutual Funds Differbetween

Closed End Fund Definition Examples How It Works

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

5 Reasons To Use Closed End Funds In Your Portfolio Blackrock

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

What Is The Difference Between Closed And Open Ended Funds Quora

Closed End Fund Fs Investments

Real Estate Cefs Satisfying A High Yield Fix Seeking Alpha

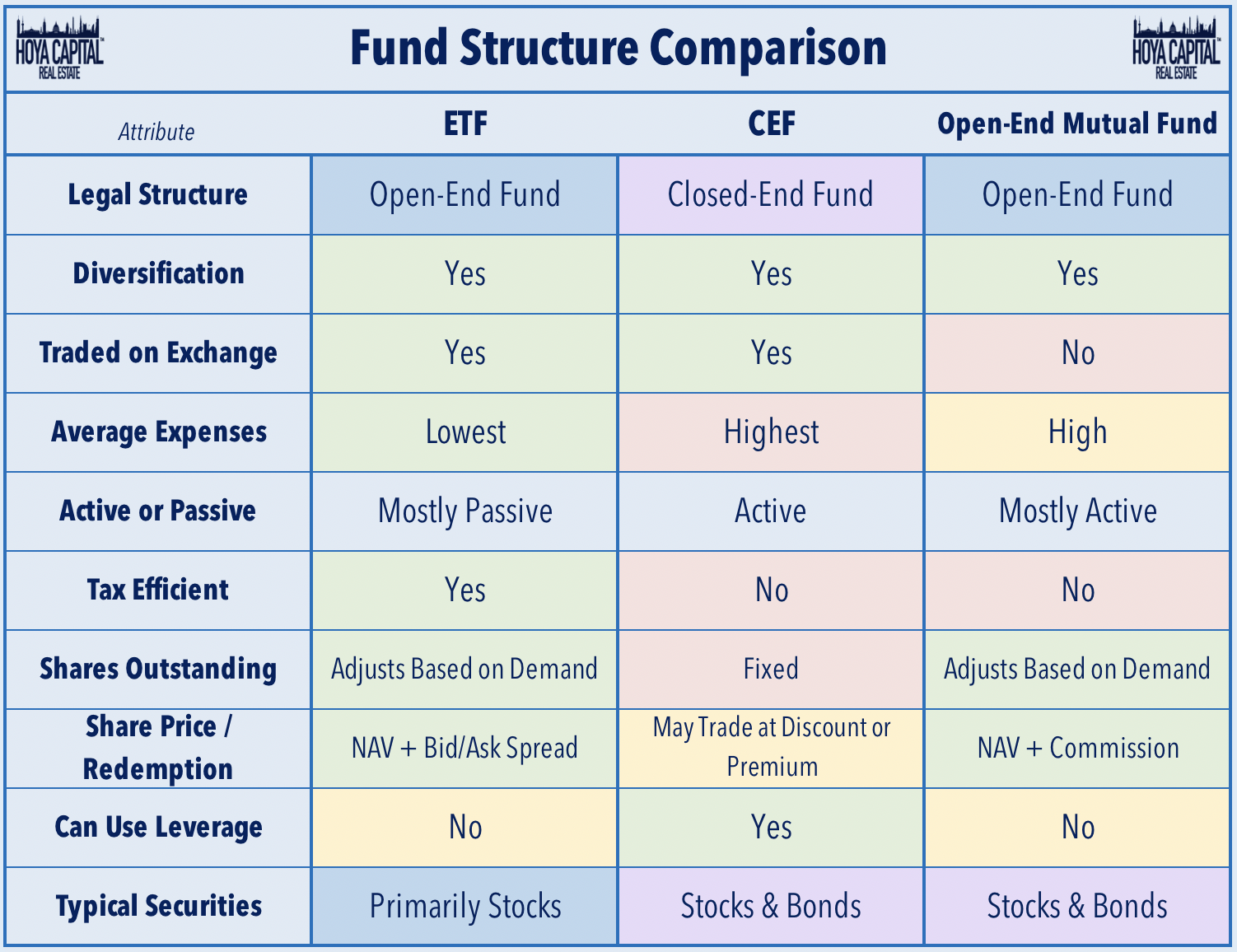

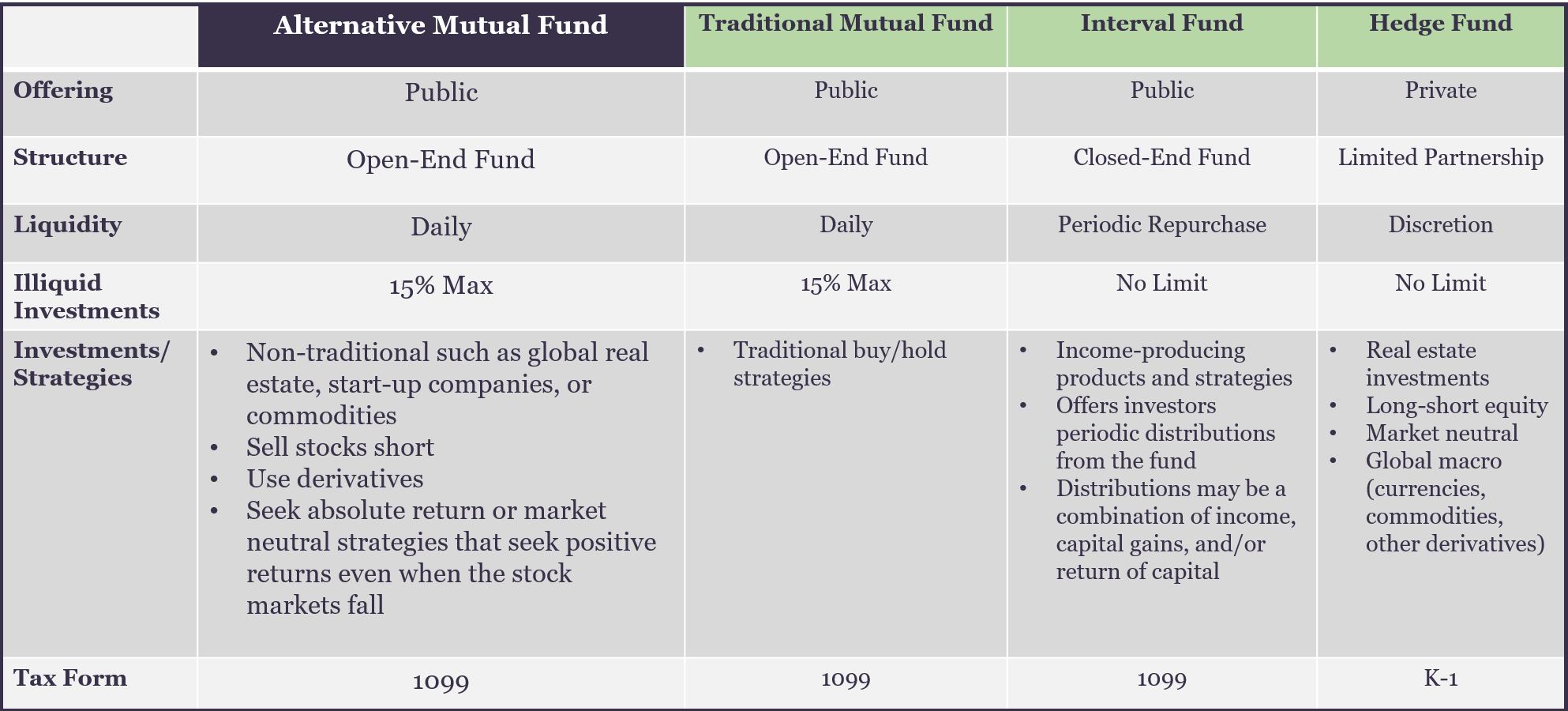

Alternative Mutual Fund Liquidity Spectrum Investment Comparison

Open Ended Mutual Fund Vs Close Ended Mutual Fund What To Prefer

Reassessing Investment And Liquidity Risks Kpmg Global

Investing In Closed End Funds Nuveen

Tourshabana What Are Closed End Vs Open End Mutual Funds Compare 4 Key Differences In Investing

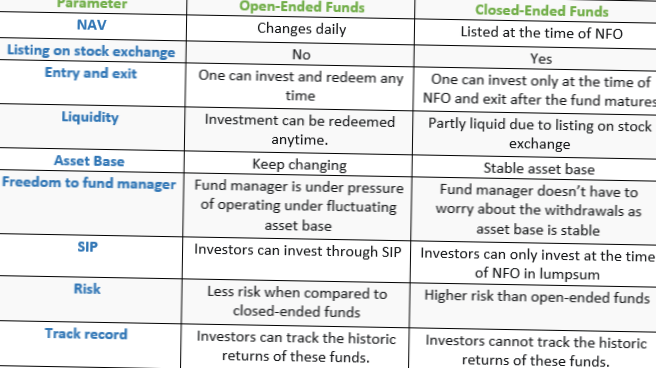

Difference Between Open Ended Funds Vs Close Ended Funds

Closed Vs Open Ended Funds Which One Do I Pick Mutual Funds Etfs Trading Q A By Zerodha All Your Queries On Trading And Markets Answered